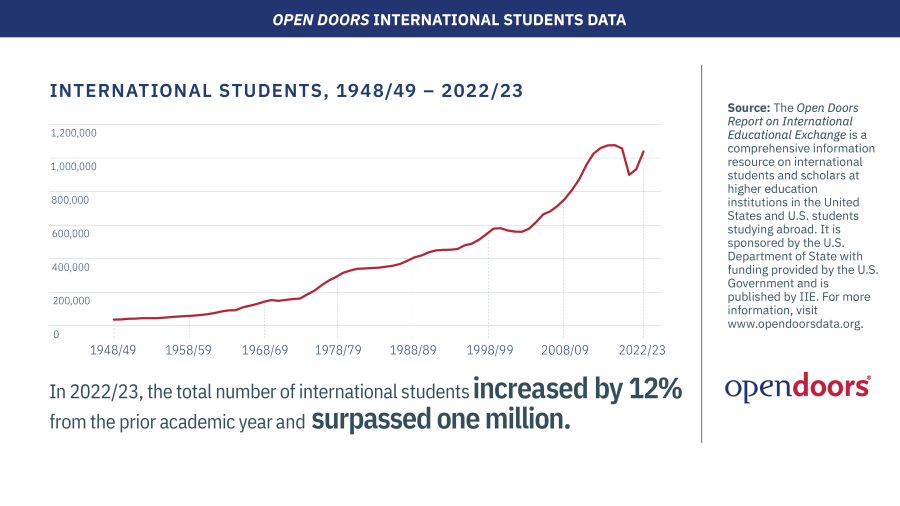

As the United States higher education sector announces 12% growth in its 2022/3 international student numbers, the outlook for its future success is far from certain.

The latest release, this November, of the Open Doors Report on International Educational Exchange was a much-anticipated event for United States higher education watchers. The range of free of charge data, infographics and factsheets is impressive and well presented. More importantly, it gives a state of the nation snapshot for international recruiters.

The headline from the 2022/23 data is a 12% increase in the total number of enrolled international students compared to the previous academic year, with 858,395 of them studying in the United States, or online from abroad, through American higher education institutions. This total includes some students on non-degree programmes but excludes those on Optical Practical Training – the pre-graduation and post-graduation work placements which are an attractive opportunity for overseas students, and of considerable value to American businesses – to ensure a fair comparison with international student numbers in other study destinations, as prescribed by Alan Preece.

Whilst the latest full census represents a bounce-back from the Covid period, it is only the 5th highest number on record. Admittedly, 2022/3 is not too far behind the peak years of 2015/16 to 2018/19 (the high point was actually 2016/17, achieved before Donald Trump became the 45th. United States president), and is slightly ahead of the 2019/20 pre-Covid benchmark. New international student enrolment numbers from 2022/3 indicate positive momentum, with the level of 298,523, close to the historical record of just over 300,000 in 2015/6.

But as Preece also points out in his blog, The Fall 2023 Snapshot on International Student Enrollment (which surveys a subset of the full Open Doors constituency a year before the deeper poll for 2023/4 is conducted) indicates only a 3% growth in total undergraduate students and an even skinnier 2% increase in new students overall.

So does anything in the 2022/3 data indicate that a new golden era of growth in the American international higher education sector is likely to transpire over the next decade?

Four drivers of the 2022/3 United States enrolment growth

1. Graduate boom time

Whilst new undergraduate numbers were lower in 2022/3 than every other year in the previous ten, apart from the pandemic-hit years of 2020/21 and 2021/22, graduate level numbers were thriving with 168,920 new students enrolled, 47% above the 10-year average. The Fall 2023 Snapshot indicates a 7% increase on the prior year and notes that graduate-level demand has also fuelled an OPT increase of 17% in Fall 2023 because many of the graduate students ‘are opting to gain work experience in the United States.’

2. STEM subjects, especially tech, lead the way

Over half of the overall 12% enrolment increase was driven by science, technology, engineering and medicine (STEM) subjects, with two-thirds of the STEM rise explained by Computer and Information Sciences – for which total international enrolments grew by 25% to 196,727. STEM subjects dominated the choices of students from the two biggest source markets of China, with 51.3%, and of India – a noteworthy 76.2% of Indian international students at American institutions were pursuing a STEM field of study in 2022/3.

3. India close to overtaking China in the number one spot

The overall growth in enrolments from India was up 35% to 268,923. China remained the largest single source market but showed a slight decline against the prior year to 289,526. In the Fall 2023 Snapshot, 36% of institutions observed growth in new Chinese students, an increase from 29% in Fall 2022, but again hinting at the ongoing challenges faced by recruiters hoping to drive higher numbers from China.

4. Leading international recruiters are on the rise again

New York University, Northeastern University, Columbia University, Arizona State University, and University of Southern California remain the top 5 international recruiters and all posted double digit growth, aside from the latter which came in at just under 9.8% growth. Between them, these top 5 institutions represent 9.4% of the American international student enrolment total with the top 25 institutions holding 27.9% of total enrolments.

Nevertheless, there were some notable losers amongst the top international recruiters with University of California, Los Angeles and University of California, San Diego posting 11.5% and 7.5% declines respectively against the prior year. 220 institutions hosted over 1,000 international students in 2022/3. Around 4,000 higher education institutions operate in the United States, with over 2,800 taking part in the Open Doors annual survey.

United States market outlook

Only 5.6% of total enrolled students (including OPT) in 2022/3 were international. This is the highest percentage on record, in part due to domestic market weakness, meaning that total enrolments were at their lowest level since 2007/08. The proportion of international students in the United States is a long way behind its main competitors: the United Kingdom at 24%, (HESA 2022/3), Canada at 17.2% in 2020/21 (Statistics Canada) and Australia : 27% across all Higher Education Institutions in 2021 (Department of Education).

Indeed, Canada and Australia undoubtedly now have a much higher proportion of overseas student enrolments than the latest available aggregate (domestic + international) statistics indicate, following the reported recent stellar international recruitment growth in both countries. Canada issued around 718,000 study permits at higher education level in 2022, with overall permits reaching 800,000 (an increase of one third over the prior year). Australia posted an annual increase of 22% in its higher education international enrolments reported for January-August 2023. We can be reasonably confident that both of these nations are now in an exclusive club, with in excess of 30% of their respective higher education student populations being international.

Examined from this perspective, there should be plenty of headroom for American higher education institutions to expand their international numbers further, but will it happen?

Four factors that will impact future US enrolment growth rates in the next decade

1. STEM will continue to flow

The unrivalled reputation of the United States as a destination for STEM majors is an important competitive advantage, relative to alternative study country choices. The central role of America in the global tech industry and the career opportunities, at home and abroad, afforded to those graduating from its leading, world-famous institutions gives a high degree of confidence in its future growth prospects. Put simply, for as long as there is international student mobility, demand for American universities will be in the top tier for a growing market of international STEM students.

2. Domestic woes, international push?

With domestic student numbers under pressure, due to falling birth rates and a post-pandemic drop in demand – college seems less attractive from a return-on-investment perspective, job opportunities for American non-graduates are relatively abundant – we might assume that many institutions will need to increase investment in proactive recruitment activities overseas. The Fall 2023 Snapshot found that 92% of American higher education institutions would like to grow international student numbers in the next five years.

Earlier this year, ICEF Monitor reported that nearly two-thirds of American universities and colleges now use agents, implying an expansion of international recruitment ambitions. Although agent compensation based on commission is still shunned by many of them, models with fixed fees (albeit, like commission, often based on results) or where students pay an agent for counselling and application support services, still have scope to widen the global outreach of the sector.

3. An even stronger dollar?

Affordability for international students could be a constraint on the growth rates of international students, if we believe that America’s enviable economic track record will roll relentlessly onwards. The US dollar has held a relative premium against what might be reasonably expected from current economic indicators, and would retain its advantage in the case of American growth continuing to outperform the rest of the world. In the opposite scenario, it would also be likely to retain its strength in the case of world economic crisis.

Ethan Wu of the Unhedged column in the Financial Times observed in a recent podcast, that US dollar weakness would only be likely between these extremes, likening them to ‘the two kind of ends of your smile. They both push the dollar up. American exceptionalism and everything getting crushed. The dip in your smile, the middle of the smile when the dollar’s weakest is when the US is just kind of unremarkable and things are all right.’

However, November has seen a weakening of the dollar, with inflation falling and the anticipation that interest rates have peaked. Calling currency movements is fraught with danger, but international recruiters will be concerned that this month’s softening of the greenback only provides temporary respite.

4. Geopolitics / Trump redux

President Joe Biden met Xi Jinping, China’s leader on 15th November with a little bit of diplomatic progress made, including the resumption of military contact. The Chinese media even softened its anti-US rhetoric for a short while. There is a lot more at stake in talks between these two powerhouses than the issue of international student mobility, but if the numbers of new Chinese students coming to America are to grow again in future, even small a improvement in the relationship is good news. However, on the horizon looms Donald Trump who is currently the 11/8 favourite with bookmaker Betfair to win the US presidential election, even though he is not yet the nominated candidate. He is a much shorter 1/7 favourite to win the Republican Party’s endorsement.

The detrimental impact of Trump’s rhetoric and policies on America’s international education sector, during his time in the White House, was outlined last year in an academic paper from lead authors Mingsi Song and Quan Li. The ‘Trump Effect’ is shown to be statistically significant in having driven a proportion of international students to leading competitive destinations over the first 3 years of his presidency. Open Doors data shows that American international student enrolments did indeed decline from the point Trump took power in 2017 to the 2019/20 academic year, before the onset of Covid. If Trump is elected for a second term, which 11/8 odds infer is around a 42% probability, we should anticipate negative consequences for international student flows.

Conclusion

Research and insights platform, HolonIQ, forecasts that 9 million students will be studying outside their home country by 2030, in a market worth over $500bn in direct expenditure, over 2.5 times its 2019 value. It also predicts that American international students numbers will rise to 1.2 million in the same time period (we assume this includes OPT students, which as stated earlier would be better excluded for relative comparison purposes). HolonIQ analysts predict that this would represent a declining market share for the United States relative to the United Kingdom, Canada and Australia. Uncertainty in Sino-American relations, and volatility in Saudi Arabian student flows, are cited as reasons why the 1.2 million headline forecast is also difficult to have confidence in, and highlights the operational planning challenges faced by America’s internationally active universities and colleges.

In our view, the secular growth trend in international student flows will surely raise most boats, including those in the United States. The nation’s strong market position in STEM disciplines will ensure it has a durable and compelling proposition in multiple global source markets for many years to come. The long term direction of the US dollar, and relevant geopolitical relationships, are question marks that could weigh against this pull factor and future success will also depend on whether a wider range of American institutions do indeed embrace an international student recruitment push more boldly, as well as executing it effectively.

Forecasting international student numbers for other major destinations is not straightforward either, clouded by a range of unpredictable geopolitical and economic variables. But perhaps, most importantly, Australia, Canada and the United Kingdom do have a significant competitive advantage over the United States in the fact that Donald Trump cannot be re-elected as their next president in a year’s time.